Simplify Lease Asset Management

— Built for Global Accounting Standards

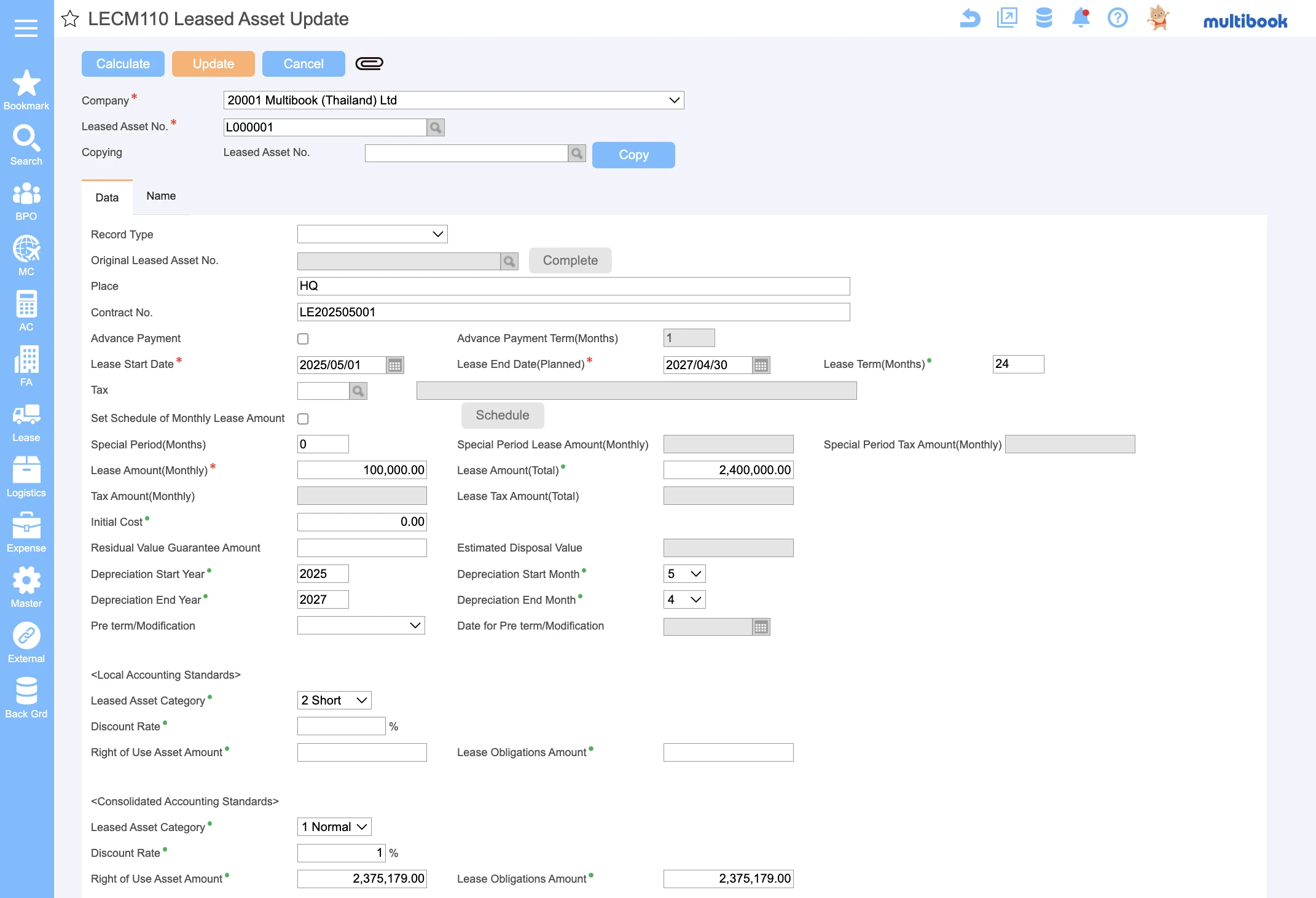

Automate lease asset accounting, streamline consolidation, and stay compliant with IFRS and local GAAP — all in one platform.

Lease Accounting, Made Effortless

From IFRS16 to local GAAP, managing lease assets across multiple entities is complex. multibook automates lease calculations, journal entries, and disclosures — eliminating manual work and ensuring compliance, accuracy, and speed.Maximize efficiency and compliance with a cloud-native accounting solution covering local and international requirements.

- Auto-calculated right-of-use assets and lease liabilities

- Multi-ledger management (Local and IFRS)

- Automated amortization and interest recognition

- Consolidation-ready reporting

Make Lease Management Smarter

Key benefits that transform your lease accounting operations

-

IFRS & Local Compliance

Stay compliant across Asia with built-in support for IFRS16 and local GAAP.

-

Automation-First

Automatically calculate lease liabilities, ROU assets, depreciation, and remeasurement.

-

Multi-Ledger Support

Manage both local accounting and IFRS books in one system with no add-ons required.

-

Seamless Integration

Connect with core accounting and consolidation modules for end-to-end visibility.

Ready to Simplify Lease Asset Management?

Designed for Regional Subsidiaries.

Trusted by Global Headquarters.

Whether its managing 10 leases or 10,000, multibook adapts to your global structure.

Our customers use it to centralize lease data, reduce audit time, and enable transparent, real-time reporting for HQ.

Why Choose multibook for Lease Asset Management

Capabilities that set us apart in the market

-

Multi-Ledger, Multi-Entity

Support for IFRS, J-GAAP, Thai GAAP, and others

— all within one database. -

Fully Automated Calculations

Automatic lease liability recognition, depreciation, and discount rate settings.

-

Scalable SaaS Model

Simple pricing with no custom development required.

-

Built for Speed

Go live in only 2 weeks with expert-led implementation.

Start your journey to stronger Asian subsidiaries.

See multibook Lease Management in Action