multibook

IFRS16 leased asset Management

Break free from Excel and enable seamless global lease management

Contact usIFRS16 leased asset Management

- Regarding operating leases,

Recognising right-of-use assets and lease obligations - Two ledgers must be maintained: one for the standalone account and one for consolidated adjustments.

- From local rental processing to IFRS16 principle processing

Automated Consolidation Adjustment journal entry Entry - Managing lease contracts at overseas subsidiaries,

A mechanism for preparing consolidated adjustment journal entry

What is IFRS16?

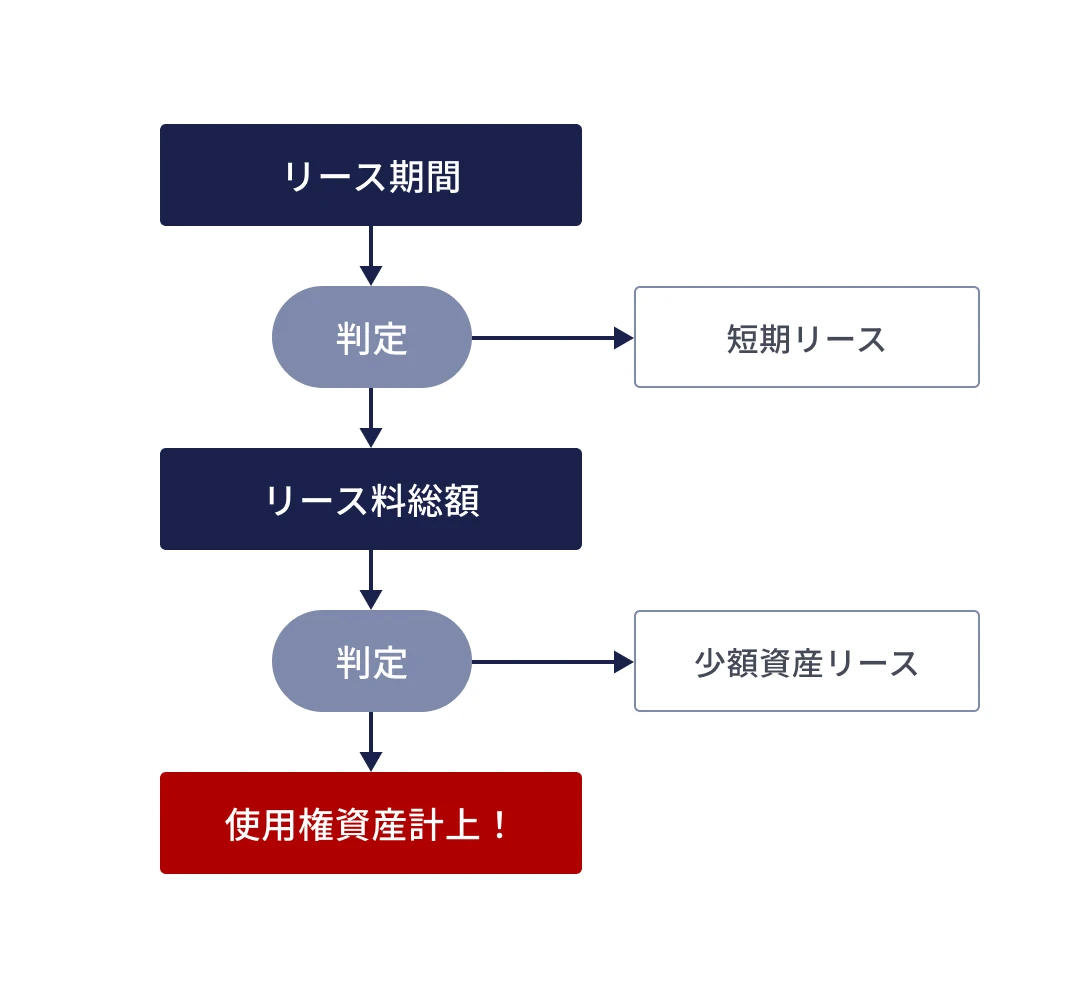

Under IFRS 16, for all lease transactions except for short-term leases and leases of low-value assets (accounting treatment similar to conventional operating leases * no right-of-use assets or lease obligations are recorded, and fixed lease expenses are recorded over the lease period), lessees are required to recognize the right-of-use as an asset and record lease obligations.

IFRS16 Requirements

The IASB (International Accounting Standards Board) announced a new standard of lease accounting, IFRS16 “Leases,” in January 2016. IFRS16 is effective for fiscal years starting in or after January 2019, and from the fiscal year ending in March 2020 for companies with fiscal years ending in March.

Instead of on-balance processing (capitalization) for all lease contracts, off-balance processing (expense) will be necessary depending on the lease amount and lease period.

When applicable for on-balance processing, contract, right-of-use assets, and lease obligations must be recorded; however, lease obligations require recording with the discounted present value of the total lease expense, and right-of-use assets require recording also with the amount including initial cost.

Regarding right-of-use assets, for depreciation and lease obligations, interest expenses and lease obligation repayment must be recorded every month. Compared to conventional operating lease management, this requires an immense amount of effort; thus, efficient operation utilizing a system is desired.

Journalization Example

Lease period: 5 years / Payment amount: 200,000 yen (once a month) / Discount rate: 5%

Conventional Lease Accounting

Monthly (lease expense included)

| Debit | Credit |

|---|---|

|

Rental Expense

200,000

|

Bank Account

200,000

|

New Lease Accounting Standard IFRS16

Contract

| Debit | Credit |

|---|---|

|

Right-Of-Use Asset

10,598,140

|

Lease Obligation

10,598,140

|

Monthly (lease obligations amortization)

| Debit | Credit |

|---|---|

|

Lease Obligation

155,841

|

Bank Account

200,000

|

|

Interest Expense

44,159

|

Monthly (Depreciation included)

| Debit | Credit |

|---|---|

|

Depreciation

176,636

|

Right-Of-Use Asset

176,636

|

multibook IFRS16 Leased Asset

Feature 01

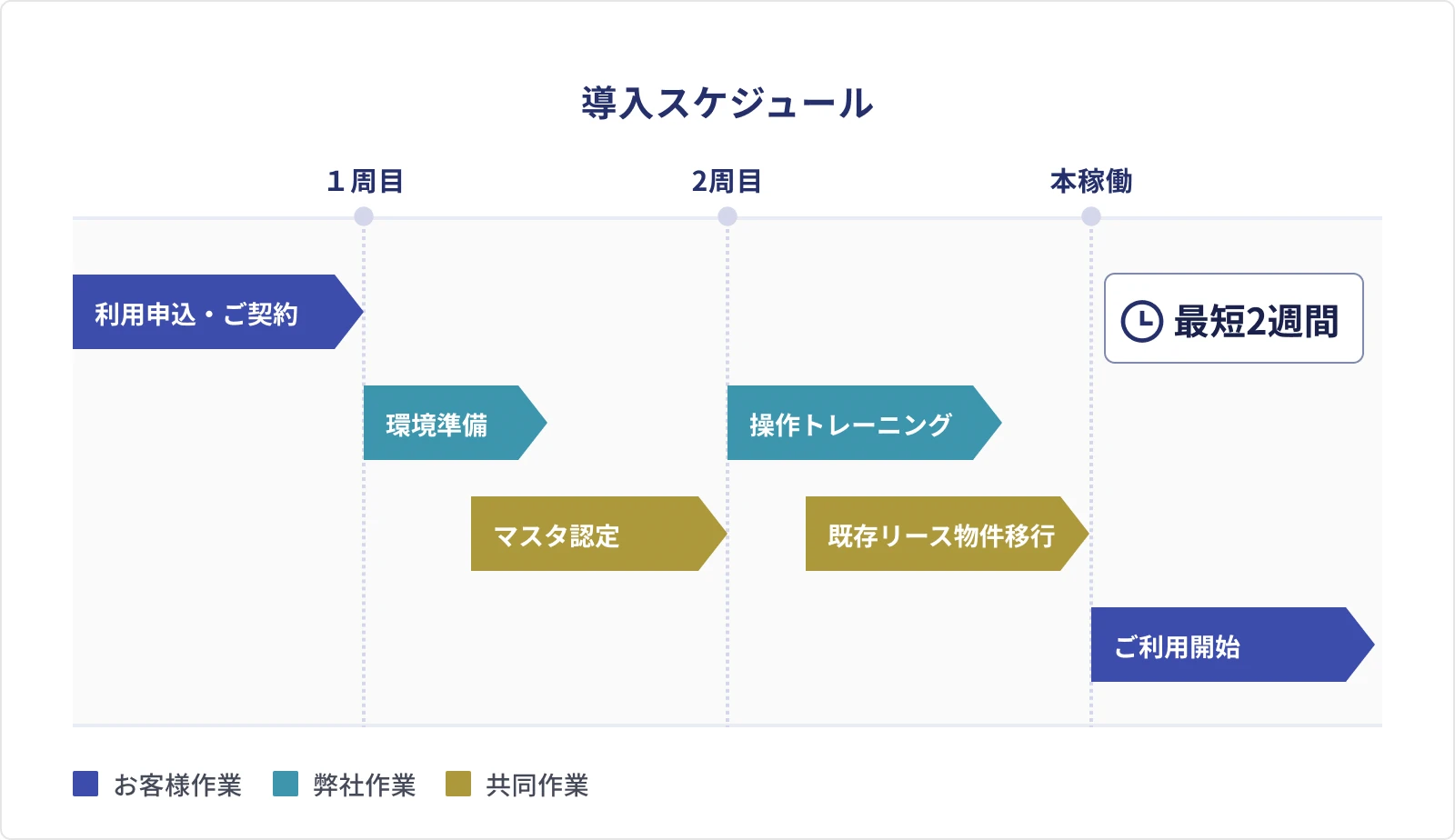

Quick and high-quality implementation

Our professionals, who are well versed in leased asset management, will implement a high-quality system in as little as two weeks.

Feature 02

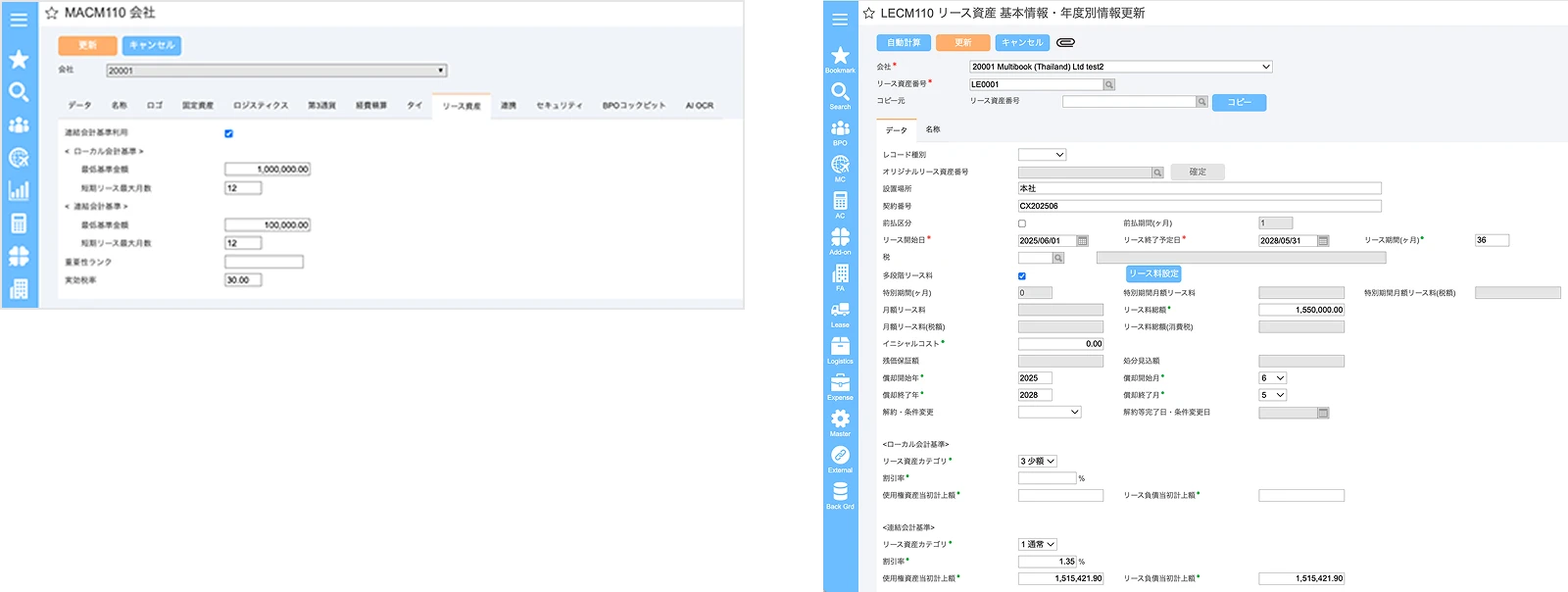

Supports Multiple Ledgers (Local and IFRS Standards)

We retain and manage both information based on the rental accounting method and interest-included method adopted by overseas bases, and information based on the principal method according to IFRS standards.

Feature 03

Equipped with Automated Calculation and Judgement Functions

- Hold minimum standard amounts and short-term lease maximum-months periods for each company, and automatically judge short-term, small-amount, and ordinary assets.

- A master discount rate is maintained and the discount rate is automatically set based on the lease start date and lease period.

- The system automatically calculates the initial amount of the right-of-use asset, the initial amount of lease obligations, the monthly lease obligations repayment amount, Depreciation amount, and even lease obligations amount when conditions change and the right-of-use asset adjustment amount.

Feature 04

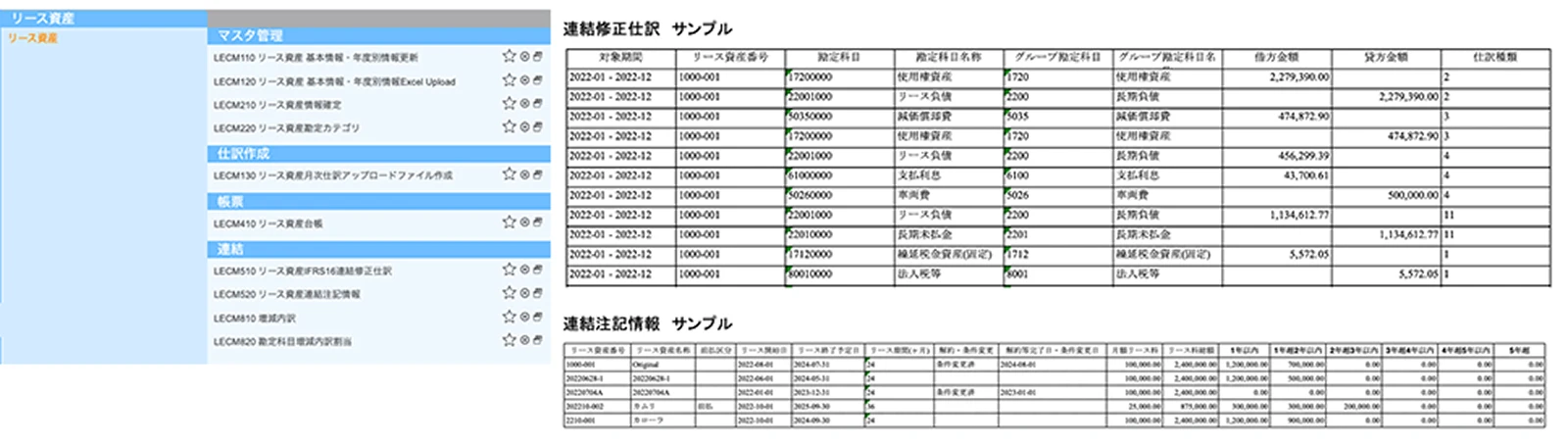

Consolidated consolidated adjustment entry feature corresponds to the application of IFRS only for consolidated financial statements,

Equipped with consolidated notes features

In addition to a single journal entry feature to multibook’s accounting feature, we also provide consolidated adjustment entry and consolidated notes output features for consolidated-only IFRS application.

Feature 05

Effortlessly Functional Across Global Locations

Supports 12 languages*

Japanese, English, Thai, Vietnamese, Korean, Burmese, German, French, Spanish, Chinese (Traditional) (Simplified), Indonesian