Comprehensive Solutions for Global Accounting Challenges

at Local Offices and Headquarters!

multibook

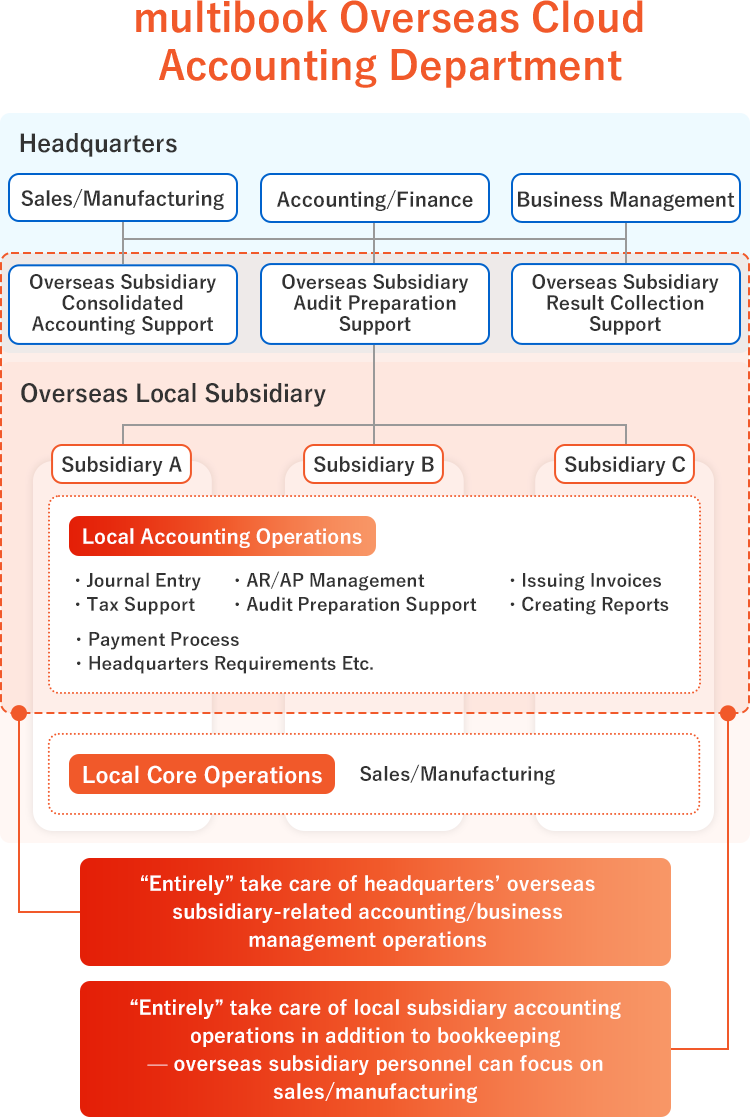

Overseas Cloud Accounting Department

~ multibook outsourcing ~

Global Cloud Accounting Department lets you

fully outsource accounting tasks for local subsidiaries

and HQ's overseas needs.

Rely on us for seamless accounting outsourcing across the globe.

Facing challenges with overseas subsidiary accounting or managing global branch finances from headquarters?

Overseas Subsidiaries

-

Accounting talent is hard to find and expensive

-

Hard to hire, harder to retain

-

Global accounting and tax rules are hard to grasp

-

Swamped with HQ reporting

The barrier between HQ and local offices

Head Office

-

Monthly reports take too long

-

Can't track mid-month performance

-

Insufficient tools and know-how for fraud risk

-

Lacking communication with local teams

“ Overseas Cloud Accounting Department ”

We take care of accounting for both your local subsidiaries and HQ,

addressing all your global accounting needs.

Overseas Subsidiaries

Little accounting team needed

- No need to hire local accounting personnel

- No need to worry about human resource development and retention

Immediate overseas local response & head office reporting

- Overseas Cloud Accounting Department will take care of everything like the legal requirements of each country and reporting to headquarters

Share/monitor status in the cloud

, multibook ERP

Head Office

Timely reporting

& monitoring

- Monthly performance can be grasped in real time

- Monthly reports can also be obtained in real time

Multilingual multicurrency

communication

- Overseas Cloud Accounting Department with extensive knowledge prevents fraud and manages riks

- "Entirely" takes care of communication with local members

No need to worry about language barriers

Service Range

Multibook’s Global Cloud Accounting Department handles your accounting tasks and more.

We manage everything from basic bookkeeping to local communications, consolidated data, and detailed HQ reports.

Key Features of Global Cloud Accounting Department

Global Cloud Accounting Department allows you to handle overseas accounting

without employing local accounting staff.

-

1

The multibook platform, supporting accounting operations in 30 countries, and a special accounting team will conduct accounting operations for you.

-

2

By utilizing an original ERP system and accounting operation know-how for various countries, we support multilingual local communication,

headquarters reports, and internal control. -

3

A special accounting team will create various reports and respond to detailed inquiries requested by the head office for you.

Begin operation in approximately 2 months

-

Assessment

We will understand customer goals and research/suggest the range of coverage.

-

Suggestion, Estimation, and Contract

We will suggest and make an estimate for operations fit for you. After adjustment with the customer, we will proceed to contracting.

-

Construction Work

We will build an environment that is appropriate for your contract, define reports, and create checklists, etc.

-

Begin Operation

A special accounting department will take care of your accounting operations.

-

Continue

We will continue improvements to optimize operations.

Consulting Services

Menu Example

In addition to taking care of accounting operations,

we can also provide separate services for

operations requiring advanced expertise.

| Service | Service Overview |

|---|---|

| Declaration operations regarding corporate-related taxes | Corporate tax declaration, GST (value-added tax) declaration, declaration for income tax of employees stationed abroad, etc. |

| International tax matters (withholding tax, deduction of foreign tax, transfer pricing taxation) |

Tax planning of the entire group, documentation support in preparation for transfer pricing taxation, handling of withholding tax, etc. |

| Fraud investigation, internal control related consulting | Fraud investigation including subsidiaries and affiliated companies, internal control consulting |

| M&A related advisory services | Financial advisory, valuation, due diligence, etc., by an M&A professional |

*We will introduce a partner accounting firm or consultant.