Japan new (revised) Lease compatible

leased asset management function

- Plans to release new (revised) leasing functions in Japan by leveraging know-how for IFRS16 leased asset management

- Started providing impact simulation service due to application of new (revised) lease

Japan: New (revised)

towards lease application

multibook support

The Accounting Standards Board (ASBJ) published an exposure draft of accounting standards on May 2, 2023, and solicited comments on the exposure draft until August 2023. In the future, deliberations for finalization will resume, and if accounting standards, etc. are finalized by the end of March 2024, they will in principle be applied from the beginning of consolidated fiscal years and business years starting on or after April 1, 2026 ( Early application is possible from the beginning of consolidated fiscal years and business years starting on or after April 1, 2024).

The Exposure Draft also proposes on-balance sheet operating leases for lessees under current accounting standards, which could have a significant impact on financial statements, particularly the balance sheet. Additionally, the revision will significantly increase the burden of accounting operation related to leases. It is assumed that

multibook has already released functions compatible with IFRS 16 leased asset Management in August 2020, so most of the requirements for Japan's new (revised) leases have already been implemented.

However, multibook IFRS16 leased asset Management Compatibility mainly targeted consolidated financial statements, so in order to comply with Japan's new (revised) leases, we made various improvements targeting individual financial statements. ) will be released before the start of lease application.

multibook IFRS No.16

leased asset management function

In August 2020, multibook released a function that complies with IFRS16 leased asset Management Requirements, which is the basis of Japan's new (revised) lease.

Please scroll sideways to view.

| Main features | Overview | Related New Lease Exposure Draft |

|---|---|---|

| right-of-use assets and Automatic calculation of lease obligations initial recording amount |

Automatically calculates the initial recorded amount of right-of-use assets and lease obligations liabilities, taking into account initial costs before the start of a lease, multi-month advance payments, special periods (such as free rent), residual value guarantees, and discount rates. | Similar to the provisions of IFRS 16, a lessee shall calculate the amount of lease obligations calculated at the lease commencement date for the right-of-use asset by adding the lessee's lease payments and incidental expenses paid up to the lease commencement date. In principle, in calculating the recorded amount of lease obligations, the lessee's lease payments unpaid on the lease commencement date are deducted by a reasonable estimate of the amount equivalent to the interest included therein. Calculate by value |

| Automatic determination of right-of-use asset recording | Automatic determination of short-term, small amount, and right-of-use asset recording based on monetary standards and lease contract period | Simplified treatment of small-value leases (paragraphs 20 and BC32 to BC35 of the draft implementation guidelines) |

| Responding to changes in conditions | Rather than treating the modification as a separate lease contract, lease obligations balance is reviewed based on the new terms, and the amount recorded as a right-of-use asset is also adjusted based on the difference in the review. | Changes to the terms and conditions of leases (paragraphs 37 and BC43 of the proposed accounting standard and paragraphs 41 to 42 and BC62 to BC66 of the proposed implementation guidance) |

| Terms and conditions | Supports contract conditions such as multi-month advance payment, special periods (free rent, etc.), and residual value guarantees. | |

| Consolidation adjustment journal journal entry, consolidation annotation information | Output of annotation information such as changes in right-of-use assets, maturity analysis of lease obligations, lease-related profits and losses, etc. Consolidation adjustment journal entry information output from local accounting method to IFRS16 accounting method |

Notes (paragraphs 52 to 55 and BC58 to BC61 of the Proposed Accounting Standards and paragraphs 90 to 105 and BC117 to BC138 of the Proposed Implementation Guidance) |

New (revised) lease

to meet requirements

New feature development schedule

In order to comply with Japan's new (revised) leases, we will release various improvements targeting individual financial statements before the new (revised) leases come into effect.

Please scroll sideways to view.

| Main features | Overview |

|---|---|

| Automatic journal entry from leased asset transactions | Automatically records accounting journal entry for individual financial statements required for new leased asset contracts (lease obligations, right-of-use asset recording), monthly lease obligations repayments, interest expense recording, Depreciation recording, condition changes, cancellations, etc. |

| To accounting software other than multibook Lease-related journal entry entry linkage function |

In response to cases where multibook is used for leased asset management and accounting software from other vendors is used for accounting management, automatic journal entry information from the above leased asset transactions is output in journal entry format of each accounting software. |

Due to application of new (revised) lease

Impact amount simulation service

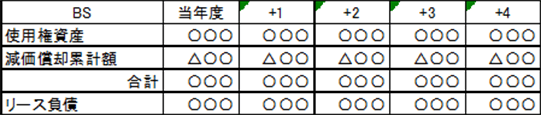

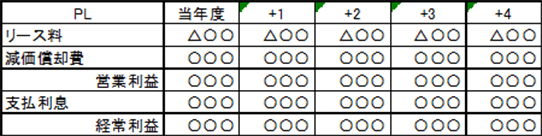

Just prepare a list of lease contracts and we will provide you with a simulation report of the impact on BS and PL for 5 years starting from the current fiscal year.

Please scroll sideways to view.

| task | Content | in charge | |

|---|---|---|---|

| 1 | Preparation of current lease contract list | Please prepare a list of lease contract information such as start date, end date, monthly lease month, initial cost, and prepayment period. Also, please provide us with the discount rate to be used in the simulation. |

your company |

| 2 | Lease contract registration &Simulation execution |

We will import the above list into multibook, execute the necessary functions, and calculate the impact amount. | Our company |

| 3 | Impact amount simulation Providing reports |

We will create a report showing the impact amount (*1) on BS and PL for 5 years from the current fiscal year. | Our company |

(*1. Impact amount report image)

・We can also provide detailed reports.